FFARS TAMISEMI Login Documentation – FFARS Online Documentation

FFARS USER GUIDE

1 General information

1.1 INTRODUCTION

Facilities or service providers are key organs at the lower level government that deal with direct provision of services to the citizens. They are therefore wings of Local Government Authorities (LGAs) and hence accountable to the same.

For quite some time, accounting and reporting system at the facility level has been characterized by individual sectoral systems, health and education sectors being dominant. This has led to lack of unified system of accounting and reporting and difficulties in LGAs capturing accurately expenditures spent at the facility level.

There are also significant current developments aimed at improving the LGA Planning and Reporting System (PlanRep) as well as the LGA accounting software (EPICOR). These improvements aim to make the high level LGA systems interoperable or able to talk/integrate with Facility Financial Accounting and Reporting System (FFARS) especially on planning & budgeting (PlanRep), and expenditures tracking (EPICOR).

There is a significant increase of funds at the disposal of the facilities. For instance, the government, with effect from 1st January, 2016 started disbursing funds for education directly to facility bank accounts (primary and secondary schools) to cover for capitation grants, compensation for school fees and food. Similarly on the side of health sector, user fees, results-based financing (RBF), community health fund (CHF) and National Health Insurance Fund (NHIF) are disbursed directly to health facility bank accounts and health basket funds (HBF) will start being disbursed directly to health facility bank accounts with effect from 1st July, 2017.

The requirements of laws, regulations and standards must also be considered. For instance, IPSAS 35, with effective from 1st January 2017, demands consolidated financial statements which includes accounts of all levels in the LGA i.e. both higher and lower government levels.Therefore, there is urgent need for existence of sound and proper system of accounting, financial management and reporting (as required by law) at the facility level to ensure maintenance of complete, realistic and accurate accounting records; preparation of timely and realistic financial reports and ensure proper accounting and utilization of financial resources received by and/or availed to facilities hence contribute to effective and quality delivery of services. In that endeavour, PO-RALG, MoHCDGEC, MoEST in collaboration with PS3 and HPSS worked together to develop this system to address the above-mentioned challenges and arising issues. The responsible authorities are well aware that introducing FFARS is an ambitious effort that must be accomplished step-by-step including the shift from manual to automated systems. Facilities are able to manage and perform financial accounting and reporting and are already undertaking many of the tasks.

FFARS will help them consolidate, improve and link current accounting and reporting activities through a strengthened and comprehensive system.

The link between Local Government accounting at council and facility levels.

The accounting activities at the facility level are part and parcel of the accounting activities at the council level and thus directly link the two as explained below:

i. Planning and budgeting at the facility level feeds into the planning and budgeting at the Council level. Hence budget codes used at the council level will also apply at the facility level i.e. cost Centre codes, fund type, same GFS codes for inputs

ii. Classification of income and expenditure items will be the same at both levels.

iii. Coding of transactions at facility level will be according to the coding at the LGA level.

iv. Actual expenditures at the facility level are accumulated to determine budget performance over a given period of time e.g. end of the year at the LGA level.

v. Preparation of financial reports at the facility level should allow consolidation of the same into the LGA accounts.

vi. Auditing undertaken at the facility level is part and parcel of the auditing taking place at the LGA levels, such as ethics, standards and performance

1.1 Chart of Account Coding systems As already explained in earlier sub-section 1.2, the coding system used within the LGA, which includes facilities as part and parcel of the LGA is the guiding system across all facilities. However, at the facility level, there will be fewer coding segments, at most four (4) segments to enable simplicity at this level. The following segments will constitute the coding system at the facility level:

• Facility Code- This is the facility registration number

• Fund Source Code- Code number as provided in the LGA Chart of Accounts

• Activity Code- Code number as provided in the LGA Chart of Accounts

• Input Code- Code number as provided in the GFS Manual

Example related to a service input for the health sector: Facility: Fulwe Dispensary in Morogoro Region, Fund Source: Community health financing schemes (NHIF and User Fees). Activity: Train 6 in charges of health facilities for 3 days on Malaria prevention. Input: Allowance.

| Facility Code | Fund Source Code | Activity Code | Input Code |

|---|---|---|---|

| 101159-2 | 8 | ABCDSS | 210303 |

Example related to a service output or actual delivery of services to population: Facility: Fulwe Dispensary in Morogoro Region, Fund Source: Community health financing schemes (NHIF and User Fees). Activity: deliver malaria services to the population Input: maybe supplies, lab test, and drugs? To show that different inputs will combine to produce malaria service output?

| Facility Code | Fund Source Code | Activity Code | Input Code |

|---|---|---|---|

| 101159-2 | 8 | ||

| 101159-2 | 8 | ||

| 101159-2 | 8 |

Purpose of this Manual

This manual has been prepared to provide for a unified, simple and practical system (both paper and electronic system) of accounting and reporting covering all sectors at the facility level. It will therefore act as a reference and working tool at this level geared towards guiding the facility officials in ensuring proper accounting, utilization and reporting of all financial resources (both own and external financial resources) that are availed at the facility.

Scope

This Manual applies to all types facilities in Education and Health sectors such as Primary School and Secondary School for Education Sector and , Dispensary and Health Center for Health.

Compliance with Legal Requirements

This manual complies and refers to various laws, regulations, standards and circulars as listed below: Public Finance Act (2001) as revised 2004 and amended 2010 Local Government Finance Act (1982) revised edition 2000 Local Authority Financial Memorandum (LAFM), 2009 Local Authorities’ Accounting Guideline (LAAM), 2009 Public Procurement Act (2011) as amended 2016 and its related Regulations Budget Act (2015) IPSAS related to Local Government Authorities PlanRep and Epicor Implementation in Local Government Authorities. Various reporting formats such as Council Financial Report (CFR) and Council Development Report (CDR). Government Financial Statistics (GFS) codes in the Local Authorities Accounting. * Other instruments from sectors (Health,Education and other sectors.

1.2 System overview

FFARS is an application that allows to record Budget disbursement, expenditure and generating report at Facility level,Council lever,Regional level and Ministry level. The application provides an electronic version of Facility level Facility Financial Acounting and Reporting System.The application serves data collected to Database and it operates on mobile devices with android application system and also through web aaplication.

1.3 Organisation of manuals.

The user manual consist of five sections:

General information,System summary,Geting started,Using the System and Report.

General information explain in general terms the system and its purpuse for which it is intended.

System summary section provide a general overview of the system,the summary explain the use of software and hardware requirement,system configuration and the access level and system behaviour of any challenges.

Geting started section explain how to get FFARS and install it on device(mobile device),the section presents briefly system menu.

Using the system provide detailed description of the system functions.

Reporting section describes in what way information collected by the system are presented and how to access the information.

2.0 System summary

Provide a general overview of the system,the summary explain the use of software and hardware requirement,system configuration and the access level and system behaviour of any challenges

2.1 System configuration.

FFARS operates as both as web based application as well as mobile application.As mobile application is compatible with android 4.1 and higher version. The application requires internet connection in order to access the application use and serve data to database.Data served in database can be viewed using any web browser. After insatallation on mobile device,FFARS can be used without any further configuration.

2.2 User access level

Only registered users are able to access,use,retrieve data and serve data to FFARS database.

The system is divided into four user levels,and are categorized according to their functionalities to suit the needs of Users.

- Ministry level(Super Admin Level)

- Region Level

- Council Level

- Facility Level,

2.3 Contigencies

Incase there is no internet connection or disruption of internet connection,data can be served locally.Incase of power filure on your device(computer,laptop or mobile device) data can not be served

3.0 Getting started.

By the time you have received this manual and you want to access FFARS, you should already have access to the internet. This manual assumes the following: You have provided a Uniform Resource Locator (URL):ffars.herokuapp.com You have an administrative privilege on the site. If you do not have a username/password, contact for developers.

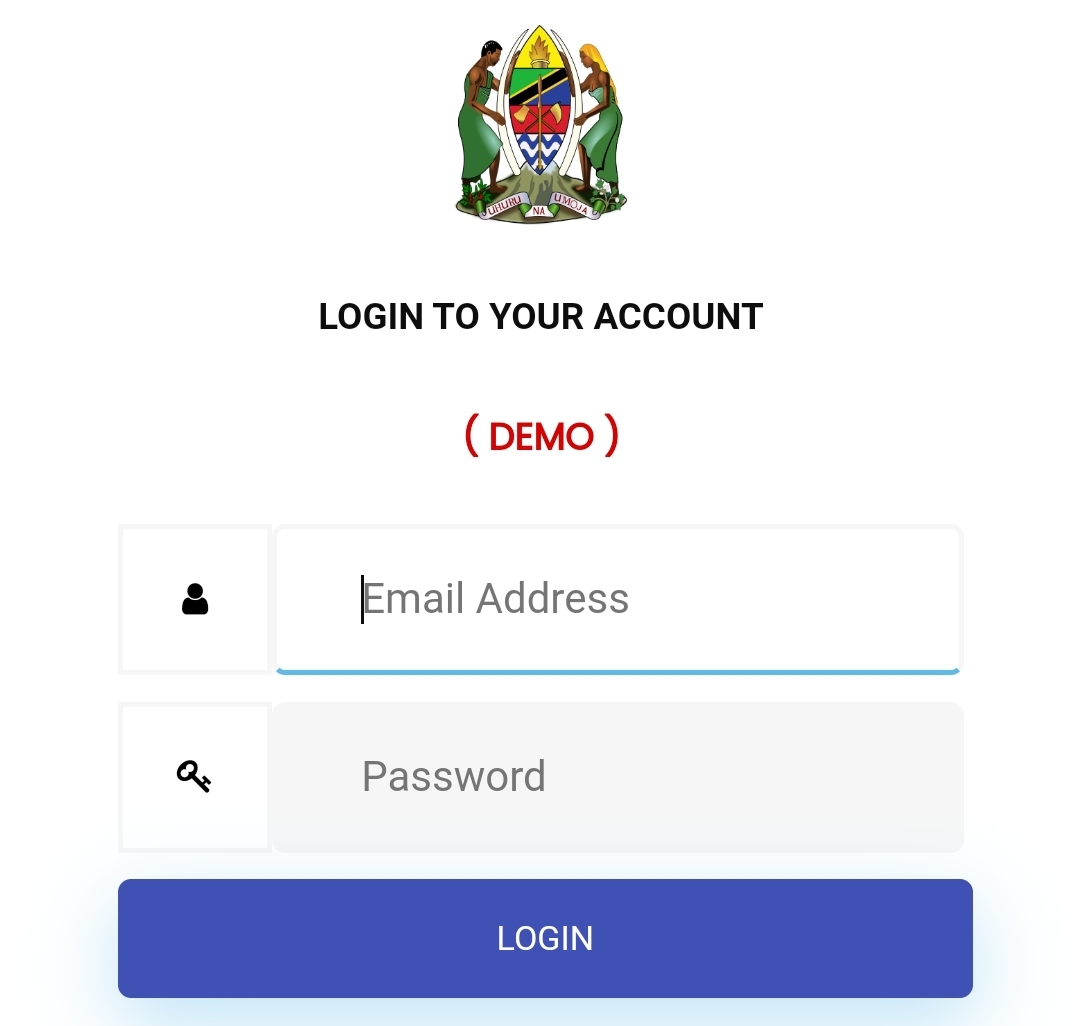

3.1 Login

Username and Password will be provided by the appropriate level.After the first login, the system will take you out so as to change default Password by choosing password of their choises.

To login into FFARS

open your browser and type the following address http://196.192.72.106

The following interface will appear

The Dashboard

When user enter User name and Password will be directed to the Dashboard and shows the amount of Money received,expenditure and balance for every level of users

3.2 Users levels

3.2.1 Supper Admin

Is the first level in which,users set the system so as the system to be accessible to other level.

The Super Admin should create other Super Admins,Regional Admins and admins for various Council in order that the Council Admin then to create the Facility Admin and Facility Clerk so as to use the system

To add new user, click add button and it shows a space for writing Full Name,Email and Assign Role. For Super Admin,will show Super admin,Regional Admin and Council Admin,and for Council Admin,it will show Facility admin and facilty clerk as shown below

3.2.1.1 GFS Codes

When is clicked, it shows GFS codes, GFS Code description

When add GFS code button is clicked, it gives you a room to enter new GFS code and GFS code Description

When add GFS code button is clicked, it gives you a room to enter new GFS code and GFS code Description

3.2.1.2 Financial Year

When is clicked, it show Start date, End date, Name, Current Year and edit.

3.2.1.3To create new Financial Year

3.2.1.4 Fund Source View

3.2.1.5 To Create New Funding Source

Click Add button and fill the required inputs

3.2.1.5 Manage Users

This part,create users and assigning Role according to their levels.

When Manage Users is clicked, shows the list of Users and Email who use the system as shown below

3.2.2 Regional Level Admin

To view report for all councils of that region.

3.2.3 Council Level Admin

Is the one who create facilities(for those which are not pre loaded) and manage users of those Facilities.

3.2.3.1 Manage Users

When Manage Users is clicked, shows the list of Users and Email who use the system as shown below

3.2.3.2 Add new users

3.3 Facility level user

At this level ,system consist of seven menus items,three menu items represent form for colleting Planing and Budgeting,Receivable and Payables and Cash Management,and two menu items represent Reporting functions of the system which are Dashbord which gives a summary of fund received,expenditure and current balance. The reporting menu provides access to diffrent types of Report for examole Cashbook report,general ledger,cachbook entries report etc.the remaining items are related to user access to the system one to allow users to change their password(change password) and the other one to exit the system(logout)

Before the system to be usable,the Super Admin should do the following

(i) Inserting GFS Codes to the system,

(ii) Inserting Financial Year,

(iii) Inserting Funding Source,

(iv) Creating various Council Admin(Manage Users),

(v) Inserting Expenditure Type,

(vi) Inserting Budget,

(vii) Sub budget class.

3.4 Planning and Budgeting

A plan is a pre-determined set of activities an organization intends to implement during a definite time period based on its policy directions (vision, mission, goals, objectives and strategies) and aiming at producing desired outputs in order to address problems or improve existing situations. When is expanded (clicked), it shows, Activities, Revenue Projections and Activity Costing As shown below

3.4.1 Activities

When is Clicked, it shows Codes and Description

In order to set for activities,you should make sure that you set Financial Year,Activitity Codes, and Activity Description that describe that nature of that Activities as shown below. To add new Activity, click the add button and gives you a room to enter Code and Activity Description as shown below

In order to set for activities,you should make sure that you set Financial Year,Activitity Codes, and Activity Description that describe that nature of that Activities as shown below. To add new Activity, click the add button and gives you a room to enter Code and Activity Description as shown below

3.4.2 Revenue Projection

When is clicked, it shows Items present, Amount, Financial Year, GFS Code, Funding Source and Actions as shown below.

– To add new Revenue Projections

In order to create new Revenue,make sure that GFS Code and Funding Source is already pre loaded into the system. click add button, and it will give a room to select GFS Code, Funding source and Amount as shown

3.4.3 Activity Costing

It is basically a quantification of the plan into monetary terms. When is clicked, it shows Amount of the given activities, Activities, GFS Code, and Fund Source as shown below

– To and new Activity Costing,

click add button and will appear as follows

3.5 Payable and Receivable

Payable and Receivable deals with Payment and Receipt in which user of the system can make transactions. When is clicked(expanded),it will show Receipt,Payment and Manage Service Providers as shown below .

3.5.1 Receipts

A receipt is an official acknowledgement of money received by the facility. when a facility want to receive money,must make sure that,the Service Providers,GFS Codes and the Fund Source are being pre loaded by the Super Admin to the system, When is clicked, it shows Receipt#, Date, Amount, Receipt Method and Receipt Status as shown bellow

-Add New Receipt

Click add button and will appear as follows

View Receipt

3.5.2Payments

The term payment is used to describe an event which can be expressed in monetary terms.

-Add New Payment

In order payment to take place,user of the system must first create Activity is going to take place,Expenditure Type and Service Providers(Payee as Supplier) and Supper Admin must also pre load GFS Code and Fund Sources.

click Add button to fill the required informations

After making Payment, the authorised person(Administrator) should confirm the Payment

After making Payment, the authorised person(Administrator) should confirm the Payment

When Check Number and confirmation date are entered,will appear as follows.

When Check Number and confirmation date are entered,will appear as follows.

Then click Preview to preview the Payment Vouchers and will look as follows.

Then click Preview to preview the Payment Vouchers and will look as follows.

Then Click Confirm in order to confirm payment

Then Click Confirm in order to confirm payment

3.5.3 Manage Service Providers

In this Manual,Service Providers are those who work with Facilities as Customers or Supplier. In order Facility clerk to make either Payment or Receive Money from various sources,must first pre load names of Service Providers.

3.5.4 Add New Service Providers

3.5.5 Expenditure Types

When is clicked,it shows Deffered Revenue expenditure,Capital expenditure and Revenue expenditure as shown below

3.5.6 To add New Expenditure type

Click add button and fill the required information as shown below

3.5.7 Facility Type

In this system, the Facility type is categorized into Academic Facility(Primary School and Secondary School) and Health Facility(Health Center and Dispensary) as shown below

3.5.8 Facility

Is a place designed for Academic purpose or Health Purpose. It shows list of available Facilities and their required informations such as Bank Account, Email, and Phone Number as shown below

3.5.9 To add new Facility,

Click add button and the required information as shown below

3.6 Cash management

This part consist of Bank Reconciliation,Journal Voucher and Doubtfull entries as shown below.

3.6.1 Bank Reconciliation.

A bank reconciliation is the process of matching the balances in an entity’s accounting records for a cash account to the corresponding information on a bank statement. It is normally carried out on a monthly basis with the key objective of identifying the items which are different between the two independent records and then reconciling them.

There are several reasons why the bank records and records kept in the facility’s cash book could be different. They include:

Cheque issued and recorded in the cash book but not yet presented to the bank for payment

Direct bank deposits not yet recorded in the cash book

Bank charges and interest entered in the bank statement but not entered in the cash book

Cheque deposited but “referred to drawer” by the bank

Errors in the cash book and/or the bank statement

To bring these items into account or to balance the two independent records, a reconciliation statement needs to be prepared every month

To make Reconciliation

Tick entries that are either reconcilide,presented Check or Cach on transit as shown below.

3.6.2 Journal Vouchers.

3.6.3 Doubtfull entries.

This part describe unknown transactions that either add or less the bank accouut.

To create Doubtfull entries

Click add button as shown bellow

3.7 Change Password

Curently,default Password is secret,user should change Password after first Login and the system will take out in order to confirm the new Password

3.8 Reports

3.8.1 Revenue and Expenditure Fund Source Report

When is clicked ,it will appear space for writing a report requirement as shown bellow

-Example of Revenue and Expenditure Fund Source Report

Fund Source Report has two parts,the upper part and the botom part. The upper part indicates the amount of money received under the GFS code,expenditure and balance of the money received under that GFS code. The botom part indicate the budget entered under the activity costing,the expenditure of the activity and the balance

3.8.2 LGA Funding Source Report

3.8.3 GFS Codes Report

3.8.4 Cach Book Report

3.8.4.1 Filtered Cash Book Report

3.8.5 General Ledger Report

3.8.6 Cash Book Entries Report

3.8.7 Creditors Report

3.8.8 Income and expenditures Report

3.8.11 Bank Reconciliation Report

Afte adjustment,make confirmation by entering the correct amount that is already balanced as shown below.

Afte adjustment,make confirmation by entering the correct amount that is already balanced as shown below.

After confirmation the monthly report will be as shown bellow.

After confirmation the monthly report will be as shown bellow.